Why does a high credit score matter to every business? This question is asked by every businessman and woman at some point or another as they embark on their business enterprise.

The short answer is that it matters because it will affect how much you can borrow from a lending institution as well as the terms that you will receive.

Let this be an exploration of the ways that your credit score will matter to your business.

What is a Credit Score?

Some people will want to know, “what is a credit score?”.

A simple way to look at it is that a credit score is a number that depicts a person’s creditworthiness.

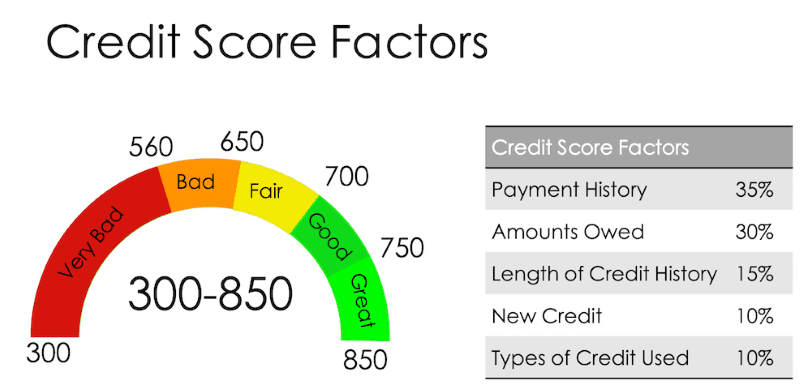

You can have a credit score ranging from 300 to 850.

For a person who wants to borrow money from a bank or lending institution, a high credit score is definitely an advantage because lenders give better interest rates to people who have a good track record of paying their debts as reflected by their score. Here is a MercureNews.com article where you can find the best credit repair companies that will help you increase your credit score.

How a credit score is determined is based on a number of factors but basically it is drawn from your credit history.

How many open credit card accounts you have, the total amount of all your debts, and your repayment history all factor into the number that will become your credit score at any given time.

It is a snapshot that describes the probability that you will pay your debt in a timely manner. If you have a good record of paying your debts on time then you are likely to have a good credit score.

Given that having a high credit score is important to individuals and businesses alike, there is a growing demand for help in raising the credit scores of people.

Many companies have stepped in to answer this growing demand.

The experts at https://creditrepairreviews.co/ share that although many credit repair companies claim to be able to raise your credit score for a low cost, only a few of them are the best at delivering the credit repair that clients need.

For people who need to raise their credit scores, paying a company for the service of improving them is a good deal.

A Brief Background of Credit Scores

There may now be more than one model for credit scores that lending institutions use, but the creation of a model for scoring credit history was started by the Fair Isaac Corporation.

This is the reason why the most used model for credit scores is called the FICO model.

It factors aspects of your credit history to date in order to assign a borrower with a score from 300 to 850.

An individual’s credit score can be determined by looking at his or her repayment history, the length of that person’s credit history, the types of loans that he or she has had to date, and the total debt of this person.

A financial institution coming up with your credit score will also look at how you used the credit that you have previously obtained. Somebody whose credit history reflects that he or she used the loan as a business investment will have a better score than somebody whose credit history is full of leisure purchases.

Improving your score is desirable for the reason that financial institutions will take you more seriously and treat you as a responsible individual or business owner. One good way to keep your credit score on the good side is to always pay your debts on time.

This practice reflects well on your credit history and shows that you are reliable and not to be considered a risky proposition to lend money to. Another way to maintain a high credit score is by maintaining and keeping active multiple credit accounts, even the older ones.

This reflects your credit history as a responsible borrower.

What the Numbers Mean

A money lending institution such as a bank will base the terms of your loan upon your credit score. The FICO score range is often used by lenders.

A score within the range of 800 to 850 is considered to be excellent.

A score from 740 to 799 is seen to be very good.

Whereas a score from 670 to 739 means good.

Having a good to excellent credit score usually means that you will receive a lower interest rate when you borrow money. In turn, a lower interest rate is good for the borrower because it means that he or she will be paying back less money. Money which could go towards other investments or needs of the individual or company.

In the FICO score range, 580 to 669 is considered to be a fair score.

A poor score is a number from 300 to 579.

Money lending institutions usually consider people with Credit score of 640 or lower to be subprime borrowers which means that the interest rate they are charged is higher than a conventional mortgage.

This is done as a way for the money lender to protect itself from the risk that the borrower will not be able to pay on time. A shorter repayment term may also be required by the lender of the borrower who has a low credit score.

In addition to that, the person who has a low credit score may be asked to have a cosigner for the debt.

Starting a business as well as expanding it sometimes requires the business owner to borrow money in order to improve production or the delivery of services.

Instead of relying on savings or income to make crucial investments for the business, a person who has maintained a good credit score will be able to borrow money from financial institutions at a favorable interest rate which equates to savings for the business.

Working on and maintaining a high credit score for you and your business is worthwhile even if you have no need to borrow money now, but if you should ever have need then you will have a favorable fallback position.